The EITC program enables Pennsylvania businesses to directly invest in the education of our youth through scholarships and supporting innovative educational practices.

What is EITC?

Enacted by the Pennsylvania Legislature in 2001, Pennsylvania’s Educational Improvement Tax Credit (EITC) offers businesses an opportunity to invest a portion of their tax dollars into innovative education programs that directly benefit students through approved educational improvement organizations such as the Pennsylvania Parks and Forests Foundation. The state Department of Community and Economic Development’s Tax Credit Division oversee the EITC Program.

Enacted by the Pennsylvania Legislature in 2001, Pennsylvania’s Educational Improvement Tax Credit (EITC) offers businesses an opportunity to invest a portion of their tax dollars into innovative education programs that directly benefit students through approved educational improvement organizations such as the Pennsylvania Parks and Forests Foundation. The state Department of Community and Economic Development’s Tax Credit Division oversee the EITC Program.

The EITC provides companies with a 75% tax credit for donations to a non-profit scholarship or educational improvement organization (EIO). The tax credit increases to 90% if the company commits to making the same donations for two consecutive years.

The Pennsylvania Parks and Forests Foundation is an approved educational improvement organization for the following two programs:

- Watershed Education

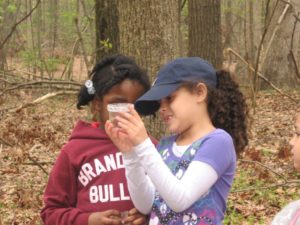

- Watershed Education is an educational, watershed-based, interdisciplinary program for students in grades 6-12, promoting classroom and field research, hands-on ecological investigations, networking, partnerships, stewardship and community service in an effort to produce environmentally literate citizens. Watershed Education takes a comprehensive approach to learning about watersheds in Pennsylvania. Instead of focusing on monitoring alone, it allows students to look at all factors, past and present, which affect a watershed. It’s an action-oriented, multi-disciplinary program that promotes investigation, research and decision-making skills. It meets many of the academic learning standards for environment and ecology.

- One Bird, Two Habitats: The Pennsylvania Connection to Central and South America and the Caribbean

- This program highlights the connections between Pennsylvania and Central and South America and the Caribbean through migratory songbirds and urban student populations. The shared habitats, of both the songbirds and many Latino students help engage students in a positive learning experience. This environmental education program addresses key environment and ecology, science, geography, and social studies standards through study of neotropical migrant songbirds with hands-on interdisciplinary activities.

- Program Goals:

- Teachers from urban communities will integrate environmental education into classroom curriculum and act as advisors to resource agencies in developing further projects.

- Break down perceived and actual barriers to the incorporation of environmental education into the urban classroom.

- Assist schools in meeting the mandated standards for Environment and Ecology, Science and Technology, Social Studies, and Geography.

How does the EITC benefit my business?

The EITC provides companies with a 75% tax credit for donations to a non-profit scholarship or educational improvement organization (EIO). The tax credit increases to 90% if the company commits to making the same donations for two consecutive years.

Tax credits are more attractive than a standard charitable donation as tax credits are utilized AFTER your tax liability is established.

In addition to the tax benefits, participating businesses support innovative educational programs as well as garner the positive public relations of their charitable work.

How does my business qualify?

Eligible businesses include those that are authorized to do business in Pennsylvania and subject to one or more of the following taxes:

- Corporate Net Income Tax

- Capital Stock Franchise Tax

- Bank and Trust Company Shares Tax

- Title Insurance Companies Shares Tax

- Insurance Premiums Tax

- Mutual Thrift Institution Tax

- Personal Income Tax of S corporation shareholders or Partnership partners.

Pass-through entities, such as S-Corporations, Partnerships, LLs, etc., are also eligible to apply.

Is the process difficult?

Not at all. New business taxpayers must submit an online application for the Education Improvement Tax Credit at the beginning of the Commonwealth’s fiscal year (July 1). Returning businesses must apply by May 15. Tax credits are approved on a first-come-first-served basis. Eligible businesses include those that are authorized to do business in Pennsylvania and subject to one or more of the following taxes:

- Corporate Net Income Tax

- Capital Stock Franchise Tax

- Bank and Trust Company Shares Tax

- Title Insurance Companies Shares Tax

- Insurance Premiums Tax

- Mutual Thrift Institution Tax

- Personal Income Tax of S corporation shareholders or Partnership partners.

Pennsylvania businesses can begin applying for EITC credits through DCED’s electronic single application system. The business application guide explains the process of applying. Applications will be approved until the amount of available tax credits is exhausted.

Once approved:

- The Department of Community and Economic Development (DCED) will send an approval letter, which starts the clock on a 60-day window in which the business makes it philanthropic donation to approved educational improvement organizations such as the Pennsylvania Parks and Forests Foundation.

- Once the donation is received by the educational improvement organization, the organization (Pennsylvania Parks and Forests Foundation) issues an acknowledgement/receipt to DCED within 90 days of the original business approval letter.

- After the acknowledgment/receipt is received by DCED, the business receives a tax credit outlined in the original approval letter.

What are the deadlines?

- May 15 – Business applicants who have fulfilled their 2-year commitment and wish to reapply.

- May 15 – Businesses who are in the middle of their 2-year commitment.

- July 1 – New applicants

What is the cost to me to participate in the program?

There is no fee to participate in the program. Please confer with your accountant on the next steps to participate in this amazing opportunity to direct your tax money to help the Pennsylvania Parks and Forests Foundation educate our youth.

Where do I apply?

The application process is extremely simple and just requires eligible businesses to fill out an online application, directions found at: http://www.newpa.com/sites/default/files/uploads/OSTC-EITC_Handbook2013.pdf.

For further details on the corporate tax credit program:

DCED Center for Business Financing, Tax Credit Division, 4th Floor, Commonwealth Keystone Building, 400 North Street, Harrisburg, PA 17120: (717)-787-7120 or [email protected]. Applications are approved on a first-come-first-served basis by date received.